Carbon tax could lower emissions and GST 18 Jul 2016

Related articles

- Brownlee Leads Aviation Mission To Shanghai News

- Sludge Report #192: The Naked Budget Columns

- Budget 2010 – Building the Recovery News

- Budget provides $321m for RS&T activities News

- Licensing To Cut Out Cowboy Advisers Migration

- Transpower gets go-ahead for $170m SI upgrade Business

- Government Widens Drought Assistance News

- Young People Take Over Parliament News

- Actions For Young Driver Safety Get Green Light News

- Imagining 2020 Series" - Contribution #2 A Low Carbon Future? Bah! Humbug! News

Carbon tax could lower emissions and GST

A new, powerful way of modelling

the impact of carbon pricing has been developed by

University of Auckland doctoral researcher Sina Mashinchi in

collaboration with experts at Cambridge University. It shows

how a carbon tax targeting emissions-intensive industries,

along with a revamped Emissions Trading Scheme (ETS), could

boost economic growth, with the extra tax generated used to

cut GST from 15 percent to 12.5 percent.

“I

wanted to show that we could move closer to our Kyoto

emission targets and still have good economic growth,”

says Mr Mashinchi.

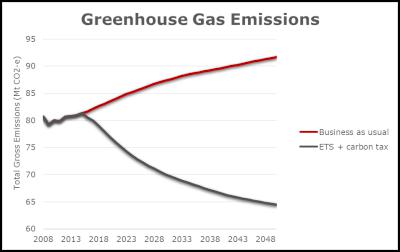

A signatory to the Kyoto Protocol, New Zealand is committed to cutting greenhouse gas emissions by five percent below 1990 levels by 2020, and by half by mid-century. But in 2013, our emissions were up 21 percent from 1990 levels.

Currently, the ETS is the main economic tool in use here to lower carbon emissions. Industries start with a set number of carbon credits, and when they use them up through generating greenhouse gases, they have to buy more. This is meant to encourage practices that will lower emissions.

Critics argue that the ETS is hamstrung by its lenient application. The government gives freebies and two-for-one deals to many industrial emitters. And even though agriculture is responsible for half of New Zealand’s emissions, it’s entirely exempt from the scheme (which is true across the world). New Zealand has also bought many “junk” fraudulent credits from Eastern Europe.

It’s widely recognised that the price of carbon credits, currently sitting around $17 per tonne, is too low to change behaviour. But the new modelling shows that even if the price was gradually raised to $300, we still wouldn’t crack our 2050 target with the ETS alone.

Mr Mashinchi argues there’s another basic problem: the ETS is based on a weak and ill-fitting model. The model he helped develop is more sophisticated and finely tuned to real New Zealand experience. While the model on which the ETS is based used only one year of data, this new model draws on 45 years of economic, environmental and energy data from 1970 to 2014.

“It shows how New Zealand reacted to global events such as the oil shocks and the Great Financial Crisis,” Mr Mashinchi says.

It also shows how New Zealanders responded to past policies, he says – not always as an economist might expect. The model that the ETS is based on assumes people act rationally, responding to policies and trends in predictable ways, “but people don’t always act rationally”.

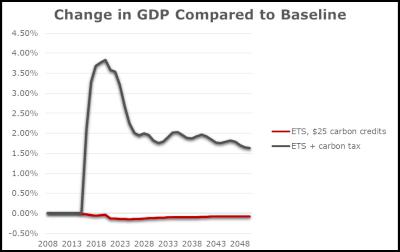

Mr Mashinchi experimented with mixes of a beefed-up ETS and a carbon tax. He found if the price of carbon credits increased to $75 right now, and rose by $20 a year from now on, and a carbon tax for non-ETS sectors was introduced and set at the same levels, the government could use the extra tax take to lower GST by 2.5 percent to 12.5 percent.

A business would either pay for carbon credits or pay a carbon tax – not both.

According to the modelling, this would stimulate the economy, encouraging investment in new technologies, energy efficiencies and public transport, which would create jobs. GDP would rise by an average 2.2 percent per year from 2016-2015, while emissions would fall 14.2 percent from current levels in 2030.

“This still falls short of our Kyoto target, but it’s a lot better than emissions going up,” says Mr Mashinchi.

Introducing a carbon tax is known as Environmental Tax Reform (ETR), something being tried in some form or another in places such as the UK, Germany, and Scandinavian countries.

“The idea behind ETR is very simple,” he says. “It’s about shifting tax from ‘good’ things to ‘bad’ things – from labour, income and investment to pollution and waste. This modelling shows it’s possible to boost GDP and the employment rate, and lower GST, through ETR in New Zealand.”

Despite the challenges ahead, Mr Mashinchi is upbeat. “We can’t blame our government over the ETS failing, because similar policies failed everywhere, and some countries haven’t even started. We should be optimistic about the future. This modelling shows us one economically viable way forward.”

END

Key

points:

• If we continue with business as

usual, greenhouse gas emissions will continue to rise under

the Emissions Trading Scheme

• New, sophisticated

economic and environmental modelling suggests a mix of

carbon tax and ETS set at much higher levels could decrease

emissions, boost growth, and fund a GST cut to 12.5

percent

• An individual business would either trade in

carbon credits or pay the carbon tax – not

both.

News

Hilary Timmins' Award-Winning UK Documentary Series To Inspire NZ Students

29 Jun 2020 Education

Dream Catchers, produced and directed by Hilary Timmins, celebrates the success stories of more than thirty inspirational New... more

New Zealand reaffirms support for Flight MH17 judicial process

7 Mar 2020 News

Ahead of the start of the criminal trial in the Netherlands on 9 March, Foreign Minister Winston Peters has reaffirmed the need to... more

Business

NZ Government's Economic package to fight COVID-19

17 Mar 2020 Business News

The Coalition Government has launched the most significant peace-time economic plan in modern New Zealand history to cushion the... more

NZ Government announces aviation relief package

19 Mar 2020 Business News

Transport Minister Phil Twyford today outlined the first tranche of the $600 million aviation sector relief package announced earlier... more

Living

Diversity was Key at New Zealand Trade Tasting in London

6 Jun 2022 Food & Wine

New Zealand Winegrowers Annual Trade Tasting was recently held in London, on Wednesday 4 May, in Lindley Hall.

It was the first... more

Kiwi author stuns Behind the Butterfly Gate

12 Jan 2022 Arts

Hidden behind the Butterfly Gate is where the secret has been kept for 76 years...

New Zealand writer Merryn Corcoran’s... more

Property

Fairer rules for tenants and landlords

17 Nov 2019 Property

17 NOVEMBER 2019

The Government has delivered on its promise to the over one million New Zealanders who now rent to make it fairer... more

New Zealand Government will not implement a Capital Gains Tax

17 Apr 2019 Property

The Coalition Government will not proceed with the Tax Working Group’s recommendation for a capital gains tax, Jacinda Ardern... more

Migration

Boosting border security with electronic travel authority – now over 500,000 issued

19 Nov 2019 Migration

19 NOVEMBER 2019

We’ve improved border security with the NZeTA, New Zealand Electronic Travel Authority, which helps us to... more

Christchurch reinstated as refugee settlement location

18 Aug 2018 Migration

18 AUGUST 2018

HON IAIN LEES-GALLOWAY

The announcement that Christchurch can once again be a settlement location for refugees... more

Travel

Gallipoli Anzac Day services cancelled

19 Mar 2020 Travel & Tourism

The New Zealand and Australian Governments have announced this year’s joint Anzac Day services at Gallipoli will be cancelled... more

New Zealanders advised not to travel overseas

19 Mar 2020 Travel & Tourism

New Zealanders advised not to travel overseas

more

Sport

The Skipper's Diary: Sir Richard Hadlee honouring his father and NZ's Forty-Niners

27 Oct 2019 Cricket

NZNewsUK London Editor Charlotte Everett spoke to Sir Richard Hadlee about why he’s chosen to publish his father’s... more

PREVIEW: All Blacks v England semi-final

26 Oct 2019 Rugby

The two most convincing quarterfinals winners are set to square off in a semifinal showdown for the ages when the All Blacks meet old... more

Columns

Gordon Campbell on the Gareth Morgan crusade

11 Nov 2016 Opinion

Gordon Campbell on the Gareth Morgan crusade

First published on Werewolf

The ghastly likes of Marine Le Pen in France and Geert ... more

Gordon Campbell on the US election outcome

10 Nov 2016 Opinion

Column - Gordon Campbell

Gordon Campbell on the US election outcome

Well um.. on the bright side, there (probably)... more

Kiwi Success

Congratulations to Loder Cup winner

26 Sep 2018 People

25 SEPTEMBER 2018

The Loder Cup, one of New Zealand’s oldest conservation awards, has been awarded to Robert McGowan for 2018... more

Appointments to New Zealand National Commission for UNESCO

16 Aug 2018 Appointments

16 AUGUST 2018Appointments to New Zealand National Commission for UNESCO

HON JENNY SALESA

Associate Education Minister Jenny Salesa is... more

Recruitment

Historic pay equity settlement for education support workers

14 Aug 2018 Recruitment

14 AUGUST 2018Historic pay equity settlement for education support workers

RT HON JACINDA ARDERN

HON CHRIS HIPKINS

Prime Minister

The... more

Historic pay equity settlement for education support workers

22 Aug 2018 Recruitment

14 AUGUST 2018Historic pay equity settlement for education support workers

RT HON JACINDA ARDERN

HON CHRIS HIPKINS

Prime Minister

The... more